Deciphering the language of big banks through inclusive design

Inspired by his autistic brother Julian, André Kennedy, MFA IxD, developed an inclusive financial system for people living with neurodevelopmental disorders.

Inclusivity has become a buzzword in the world of design of late. Major companies are racing to label their businesses inclusive. It's "good branding", as they say. But what does inclusive design really mean? And is everyone included? André Kennedy, N, believes that inclusive design still suffers from a major blind spot. Namely, people with cognitive impairments. For example, people with autism, the elderly or children. To initiate change, André developed an inclusive financial system, inspired by his autistic brother Julian.

Since World War 2, and the return of soldiers suffering from severe physical impairments, inclusive design has been about the physical aspects of inclusivity. Designers developing new products or services have focused solely on the material side of things, in order to increase accessibility in society. That's all fine and well.

However, André Kennedy argues that we also must recognize that there are large groups in society who have been overlooked when we talk about inclusive design.

As designers we have failed to consider that cognitive abilities fit into a broader definition of accessibility

andré kennedy, ixd programme

"Quite simply, as designers we have failed to consider that cognitive abilities also fit into this broader definition of accessibility. This lack of recognition of the range of cognitive abilities present in our society is evident across industries - whether it be online services for the elderly, or access to medical records for children diagnosed with a disease."

Decoding the financial language of banks

On the positive side, this realization opens up a whole new range of potential products for designers to develop. Last year, André Kennedy seized the opportunity himself and began developing his MFA graduation project, Olive. The idea was born out of seeing his autistic younger brother Julian struggle to come to terms with the financial language and products offered by banks today.

Less than 50% of adults living with autism in the UK have any control at all over how their money is managed

"Less than 50% of adults living with autism in the UK have any control at all over how their money is managed. Banks have failed to offer these groups any form of inclusive financial products, forcing their families and carers to strip them of much of their financial independence."

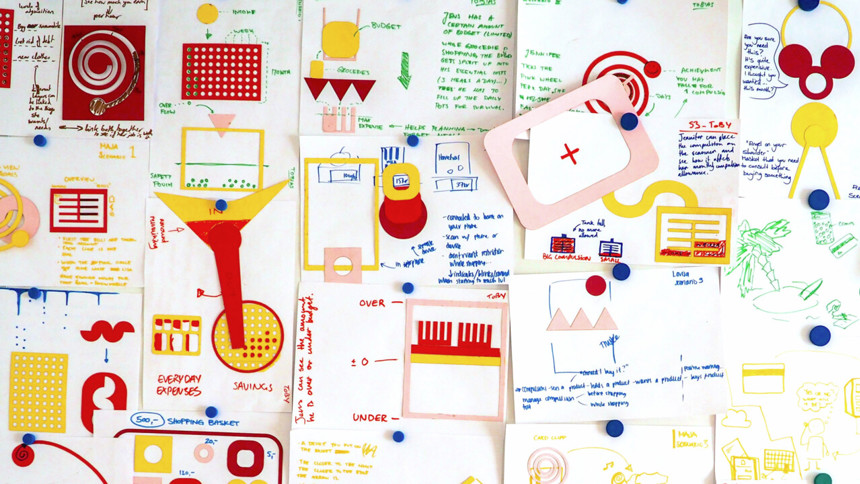

André performed extensive user research before arriving upon the final functions and visuals displayed on the Olive platform.

ImageAndre KennedyOlive, which won the award for most empowering product at the Interaction Awards in Seattle in February, is aimed at meeting the specific and individual needs of someone like Julian. People with neurodevelopmental nisorders (NDD) tend to communicate their feelings and thoughts in different ways to neurotypical people. For example, autistic people will often have trouble understanding numbers and abstract concepts such as value. So, rather than fixating on arbitrary numbers, Olive is a platform that focuses on helping people living with NDDs voice their individual needs and goals, aiming to give context to every financial decision made.

The Olive product family

With Olive, money is presented in a visual medium. Actually, it's three mediums, three products. It's the portal, the budget planner and the app. The portal budgets the monthly income. It's a mode for setting up automated payments and categorize money into different spending pools. The planner allows family and carers to set up a detailed weekly plan that the person with NDD can interact with throughout the week. And finally, the app, which handles the payment process.

ImageAndre Kennedy

"The flexibility of Olive enables carers to place rules - limits and permissions - over certain categories of money; groceries and rent for example. In this way, Olive can adapt to the individual decision-making abilities of the user."

By making the different steps of economic decision-making more tangible, relating to both planning and outcomes, Olive creates the basis for a financial language better suited to people with NDD. Also, for carers and families supporting and managing the money, Olive provides a channel through which they can gauge the needs and goals of people with NDD, ensuring their voice is heard.

Inclusive design requires inclusive methods

During the development of Olive, André stayed true to the process by utilizing exhaustive inclusive design methodologies in order to gain a deeper perspective from the users. While challenging, the experience was rewarding in many ways.

The most effective ways of working with these groups was through story-telling with Lego and long-term prototyping

"Many of these groups struggle to express how they feel. Finding suitable testing and interviewing methods proved to be a monotonous process. In the end, I found that the most effective ways of working with these groups was through story-telling with Lego and long-term prototyping. Lego proved to be an amazing way of exploring their lives of today, and the problems they face. Long term prototyping, on the other hand, allowed me to measure how their behaviour changed over time, and thus gauge whether an idea was right or not."

André's brother Julian demoing the budget planner during the development of Olive.

ImageAndre KennedyAndré Kennedy is now working towards getting Olive to reach a greater audience.

Olive has been working with some major banks who are interested in transforming their products

"The impact that Olive has had already is amazing, really. The prototype of the budget planner is still used to this day used by the family that was testing it. On the market side, Olive has been working with some major banks who are interested in transforming their products, and soon, I'll be releasing a toolkit to help support banks in this process", concludes Andé Kennedy.

Olive is unlike any financial system that exists today. Rather than focusing on arbitrary numbers, she presents an inclusive platform that focuses on helping people living with NDDs voice their needs and goals. This is supported by a suite of products that aim at helping them with the support of their family in achieving this vision.